Wall Street Opinion Journal August 25, 2006

Why is the IRS in the business of reading sermons?

When the Rev. George F. Regas delivered a sermon opposing the Iraq War in All Saints Episcopal Church in Pasadena, Calif., two days before the 2004 presidential election, he expected to upset a few members of the congregation. Instead, he seems to have upset the Internal Revenue Service, which began an investigation that is still under way. All Saints isn’t the only church to fall out of the good graces of the IRS.

Under the 1954 Revenue Act, 501(c)(3) organizations risk losing their tax-exempt status if they “participate in, or intervene in . . . any political campaign on behalf of any candidate for political office.” Over the past two years scores of organizations have faced scrutiny for allegedly mixing their political convictions with their religious ones. And this summer the IRS expanded a program it first launched in 2004 to take direct aim at political advocacy inside houses of worship.

The new crackdown, which the IRS calls the Political Activity Compliance Initiative, has so far put some 15,000 nonprofits–mostly churches–on notice that preaching politics puts them at risk of audits, fines or, in some cases, the loss of tax-exempt status. The IRS has also announced it will no longer wait for complaints to come in, but will instead take action “to prevent violations.” It will be reviewing the content of sermons, it says, as well as the financial books of religious organizations. The free exercise of religion could now come with a hefty bill.

. . . more

I’m not a big fan of political speech from the pulpit. But I’m bothered more by the fact that the IRS is determining what is free speech or not. It’s an arbitrary standard that can be imposed by the individual interpretation of the IRS agent.

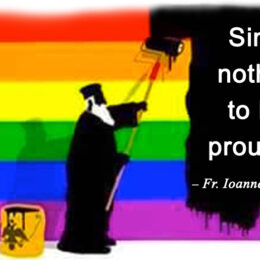

We could also find ourselves with a similar situation as Canada where pulpit proclamation against specific sins that have a political dynamic (i.e. abortion, birth control, and homosexuality) could be silenced by the government.

Here’s a link that gives some background on the case:

More…

I’m not a fan of government of government interference with religion, at all. But I think a case could be made that providing tax-exempt status to churches is a form of government intervention. And doing so requires the government to determine what does and does not constitute a religion.

…I should follow that by saying that “The Government determining what does and does not constitute a religion” is a bad thing.

The topic of political advocacy by Churches remains highly divisive one among Christians. A new Pew Forum poll on religion and public life found:

Many Americans Uneasy with Mix of Religion and Politics